The Answer is Yes.

A number of years ago, I was introduced to a short, pithy book The 22 Immutable Laws of Marketing by Ries and Trout, which is possibly the best marketing book of all time.

Why go into this on a blog dedicated to C-Level Priorities? Simply put, effective marketing should be a C-Level Priority in every company. Companies that don’t follow sound basic marketing rules spend a lot of money, waste a lot of time and fail to realize their full potential.

I want to touch on just the first two of the laws- The Law of Leadership and The Law of Category. In combination, these two laws position a company, a line of business or a brand to win and to remain a winner over the long term.

I want to touch on just the first two of the laws- The Law of Leadership and The Law of Category. In combination, these two laws position a company, a line of business or a brand to win and to remain a winner over the long term.

In late 2008, I took over a business that described itself as a “Marketing Services Provider”, and in fact they were the largest independent company in the Northeast in this line of business. I am going to call this company MSP. Unfortunately, in their largest division, MSP was making the mistake many other companies do- they had an executive with a VP of Sales and Marketing title, who really was the head of Sales. In truth, marketing in this company was sales support, and that was not being done well either. Coincidentally, MSP owned and operated two Direct Marketing Agencies, so they knew marketing. They just weren’t applying it to themselves (shoemaker’s son?).

There was a very talented marketing executive in one of the Agencies and we asked her to head marketing for the entire company. We knew we had to re-position the business and this marketing executive knew how to do that. We also knew the Marketing Services Provider “category” was too broad and we could never “own” it. Let’s take a break from this story and go back to the 22 Laws. We will return to the story after that.

Here is a synopsis of the first two of the 22 Laws:

Here is a synopsis of the first two of the 22 Laws:

Law #1

The Law of Leadership- It’s better to be first than it is to be better.

Law #2

The Law of the Category- If you can’t be first in a category, set up a new category you can be first in.

It’s important for a company to be first in their chosen area of business. If they’re not first, then the stronger competitor sets the pace and others follow. It’s also difficult under these circumstances to differentiate yourself competitively. We recognized this right away, and took a deep dive into a positioning exercise. After a thorough external search and an internal self-assessment, we settled on a new category we termed Personalized Communication. It was a segment of the services provided by a marketing services provider, and MSP was particularly good at it.

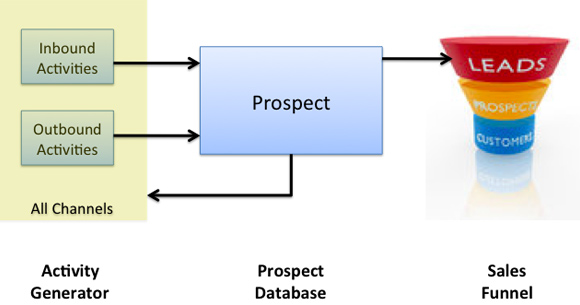

Now we had to implement. It was first necessary to get everyone in the company aligned around this concept- we began with the senior management team. From there we addressed the sales force, client services group, and on into all customer-facing units in the company. Then the tactical marketing began- website, direct marketing/lead generation campaigns, webinars, thought-leadership communications… all centered around Personalized Communications.

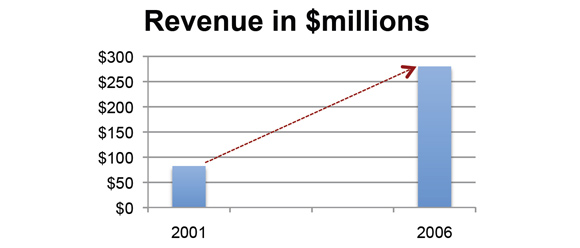

No need to get into more details, suffice it to say it worked- and here are two proof points. First, a Google organic search for Personalized Communications placed this regional provider consistently above the fold. Second, business performance improved dramatically, enough that the company received an unsolicited offer to be acquired.

Back to the main point- yes, there are laws of marketing. It’s a C-Level responsibility to make sure they are being applied effectively and not violated. In the words of Ries and Trout “Violate them at your own risk”.

C-Level executives should be thinking of the tone within their organization as a key part of the company’s culture- well beyond the “general ethical climate”. What C-Level exec’s communicate in word and in action, how they deal with issues in practice, and what gets prioritized and rewarded all dictates an organization’s tone.

C-Level executives should be thinking of the tone within their organization as a key part of the company’s culture- well beyond the “general ethical climate”. What C-Level exec’s communicate in word and in action, how they deal with issues in practice, and what gets prioritized and rewarded all dictates an organization’s tone. While the Tylenol example was an extreme case, contrast that to the manner in which Merck handled the 2004 “Vioxx scare” (the product was alleged to increase the risk of heart attack and stroke in its patients). While Merck ultimately pulled Vioxx from the market, it was only done after a long and involved series of denials. The Merck response did not set the aggressive, patient-welfare tone that J&J’s did 2-decades before. Vioxx was returned to the market after further FDA investigation, but the damage done to Merck’s reputation in the way it handled the issue lingered.

While the Tylenol example was an extreme case, contrast that to the manner in which Merck handled the 2004 “Vioxx scare” (the product was alleged to increase the risk of heart attack and stroke in its patients). While Merck ultimately pulled Vioxx from the market, it was only done after a long and involved series of denials. The Merck response did not set the aggressive, patient-welfare tone that J&J’s did 2-decades before. Vioxx was returned to the market after further FDA investigation, but the damage done to Merck’s reputation in the way it handled the issue lingered.

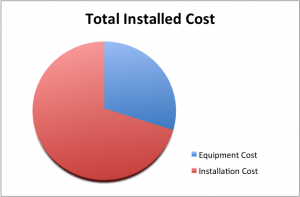

Changes to the management team were needed that largely involved reassignment of senior staff, although there were a couple key new hires and terminations as well. The second action was to right-size the organization and consolidate facilities- always a painful step, but necessary. The third action was a very important one, and that was to impose financial discipline and financial decision-making. Previously, major decisions were made without financial analysis or justification. The newly appointed CFO took this one on successfully.

Changes to the management team were needed that largely involved reassignment of senior staff, although there were a couple key new hires and terminations as well. The second action was to right-size the organization and consolidate facilities- always a painful step, but necessary. The third action was a very important one, and that was to impose financial discipline and financial decision-making. Previously, major decisions were made without financial analysis or justification. The newly appointed CFO took this one on successfully. Phase 2 then became the Market Focus phase. We took two significant actions in this phase- the first was to align our business in the way customers saw us and not how we saw things internally. We aligned as many of our resources as possible around our customer segments. In doing so, we improved our sales dramatically, but we also learned what was missing in our products and services. We immediately launched product development programs to strengthen our offerings- this took more than a year to accomplish. But, once we did, sales improved further yet.

Phase 2 then became the Market Focus phase. We took two significant actions in this phase- the first was to align our business in the way customers saw us and not how we saw things internally. We aligned as many of our resources as possible around our customer segments. In doing so, we improved our sales dramatically, but we also learned what was missing in our products and services. We immediately launched product development programs to strengthen our offerings- this took more than a year to accomplish. But, once we did, sales improved further yet. What had to be done was obvious on the one hand, but very difficult to do on the other- we had to better control our channels to market. The action we decided upon was to acquire a significant channel player with global sales and service capability, and a strong market presence.

What had to be done was obvious on the one hand, but very difficult to do on the other- we had to better control our channels to market. The action we decided upon was to acquire a significant channel player with global sales and service capability, and a strong market presence.